We might think that our decisions, whether financial or otherwise, are best in our own hands. Makes the most sense, right?

Who else would care for our possessions the same way we would? It might instill a sense of superiority to think that all our decisions are based on logical reasoning, but we’re here to tell you that that’s not always the case.

We’re sure you’d agree that sometimes, your decisions can be highly emotional. And if you don’t, we’re confident we’ll convince you by the time you’re done with this article.

Inside the World of Behavioral Finance

The technical term for studying the psychology behind investing is ‘Behavioral Finance.’ This theory states that people do not always invest rationally (working on the wider theory that states human beings are irrational actors).

The theory argues that humans are often guided through emotional judgments that can be incompatible with what logic dictates.

Common Patterns that Affect Investment Decisions

Experts have noted specific patterns in our thinking styles that mostly lead to wrong investment decisions, and how you can try to overcome making such decisions.

1. Loss Aversion

If people were to act on totally rational grounds, they would be just as happy with a $100 gain as they are when they lose $100. But, according to research, people feel the pain of loss twice as much as the joy of gain. Therefore, it is typical for them to hold on to an asset just because they want to sell it at a loss. An emotional decision, wouldn’t you agree?

Experts claim that one good way to convince yourself to sell at a loss (if that’s necessary at the time, of course) is by asking yourself if you would buy the share at this time. If the answer is no, sell it off!

2. Herding

This is the trademarked word for “following the crowd.” And while it might be okay when talking about fashion trends and such, it can be highly disadvantageous in the investment world. Typical examples would include the Bitcoin craze and the dot-com bubble.

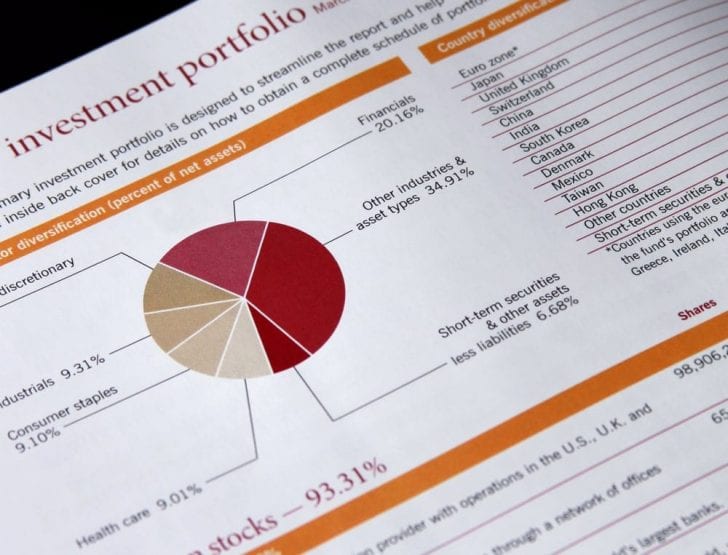

Experts state that it is VITAL that you keep your portfolio as diversified as possible! Please, don’t put all your eggs in one basket, as they say.

3. Confirmation Bias

Nowadays, thanks to the internet, there is so much information out there (some of it we can definitely do without), which makes it challenging to decide which source to believe. Sometimes, behavioral psychologists claim, we might even actively look for information that reaffirms our beliefs!

Experts claim that they’ve received their “expert” status for a reason- after gaining a lot of experience in the field, through hard work. So, shut down your inherent biases by getting balanced views and following what seems most advantageous.